General Finance

How to Increase Your Credit Score: Practical Steps

Your credit score is a vital gauge of your financial health, influencing loan approvals, interest rates, and overall economic opportunities. Recognizing that enhancing your credit score demands a systematic approach, we will explore distinctive and effective strategies in this article.

Popular Views

Top 10 Ways to Finance Your Startup Effectively

Venturing into the path of initiating a new business is a captivating and demanding endeavor. For individuals with a vision of becoming entrepreneurs, a critical aspect to address is acquiring suitable financial resources to propel the expansion of their venture. While traditional funding avenues are available, it becomes crucial to investigate fresh and distinctive approaches to fund your startup.

10 great day trading strategies for beginners test

Day trading is the buying and selling stock throughout the day. Day traders are involved in business throughout the day to gain high profits. Traders also stand a high chance of loose value if stocks are horde. Most day traders are beginners, and they trade in the hope of growing their small daily profits into a long-term gain.

accounts for free checking

You can find checking accounts with a competitive annual percentage yield (APY) and no fees. You may be able to get a better APY if you use direct deposit or make a certain number of purchases with your debit card each month, though. Depending on the bank, you may need to make a certain amount of purchases using your debit card and also have funds sent into your account via direct deposit.

Calculator for amortising mortgages

Above, you'll find a mortgage payoff calculator to help you weigh your options, such as making a lump sum payment, setting up automatic biweekly payments, or paying the mortgage off early. It determines how much time is left to pay, how much time is saved compared to other payoff options, and how much interest is saved.

Trending Reads

A credit-builder loan is not the same as a standard loan in any way. In the case of a conventional loan, you would likely receive the borrowed funds up front and repay them over time. A credit-builder loan, on the other hand, entails making regular payments to a lender before gaining access to the borrowed funds.

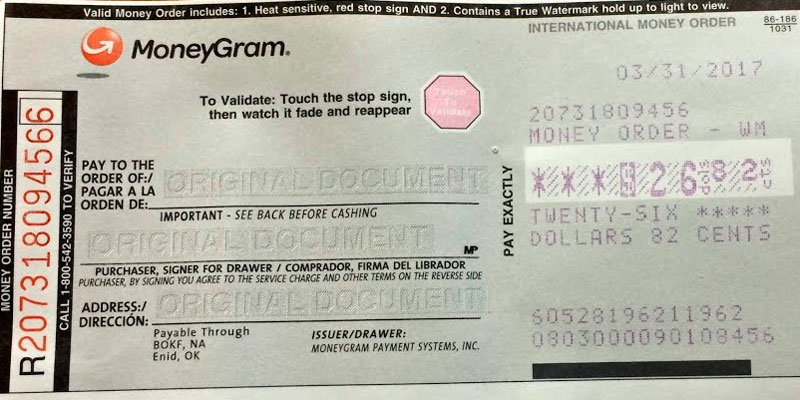

To ensure that the payee is able to successfully cash the order, it is imperative that the name on the order be correct, just as it would be on a check. Purchaser: The information of the purchaser, that is you, is required for the following part of the transaction. Please print out your full name and address.

When you use Direct Pay, a debit or credit card, or EFTPS to pay the IRS, and then choose Form 4868 or extension, you'll get a six-month extension automatically. There will be no need to submit Form 4868, If you fall into this category, you should file Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

Latest Article

Reputable Mortgage Lenders

Getting a mortgage to pay for most of the cost of a home can be a stressful and bewildering experience in and of itself. Mortgages are complex, but Select has compiled a list of the five best mortgage lenders to help you narrow down your options and find the one that's right for you.

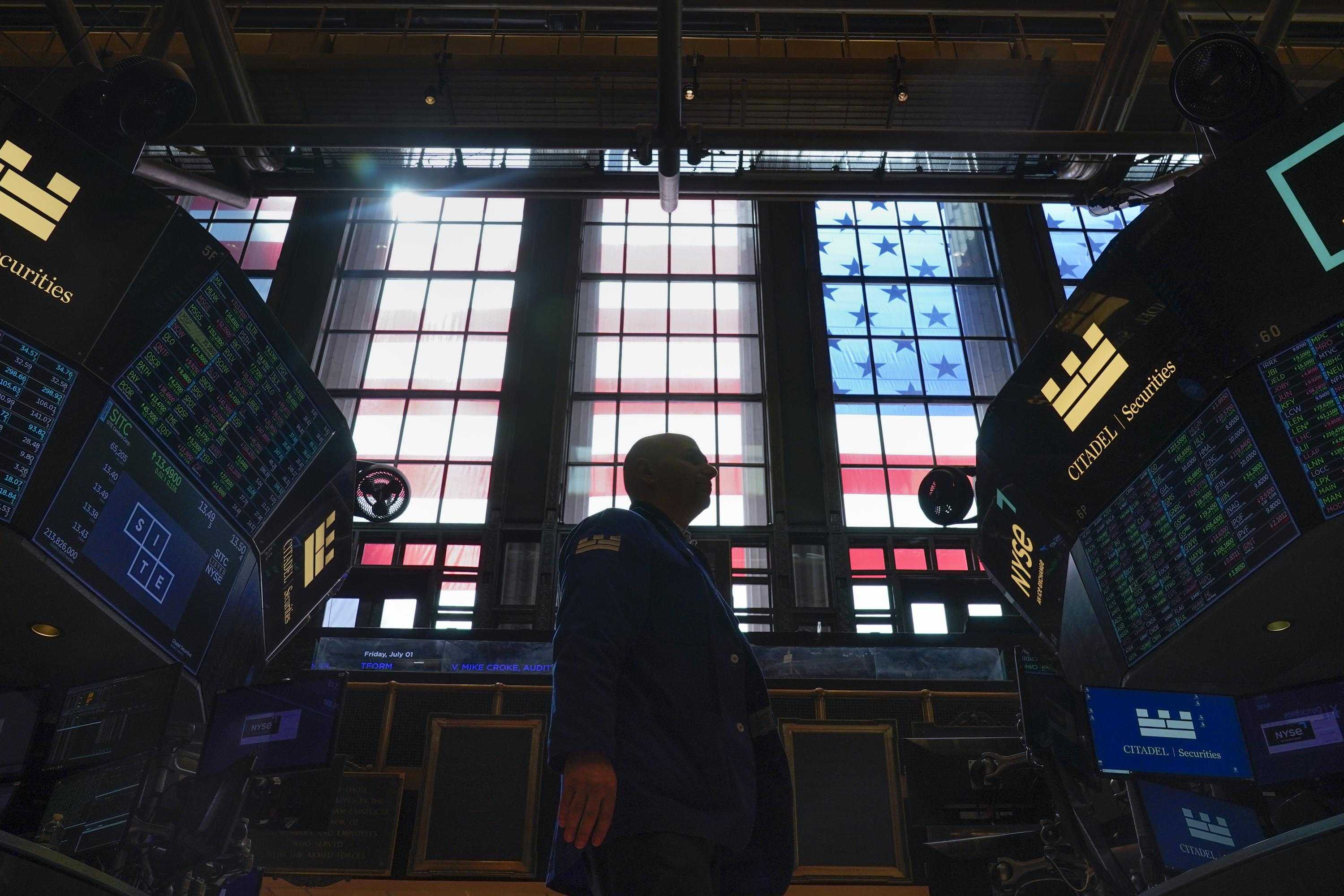

Wall Street Stocks Decline as Inflation Worries Pervade Investors

Inflation continued to worry Wall Street as the Dow Jones Industrial Average fell more than 680 points. Additionally, the pace of change in market indices has worsened each week. It's worse now than it has been in the past six months.

What is the Stock Market’s Decline Trying to Tell Us?

Investors smiled at banks during the first two years of the Covid pandemic. But now that the stock market has collapsed, all of that is history. How the day ends is not how the morning begins, and uncertainty in the stock market has investors worried.